Beyond Buy & Hold: Engineer Alpha with Stock CFDs

Deploy event-driven, pairs trading, and long/short equity algorithms on over 2100 global stocks. Capitalize on corporate events and market inefficiencies with our high-performance infrastructure.

The Ideal Playground for Sophisticated Stock Algos

Stock CFDs offer a granular way to trade the performance of individual companies. Our platform is built to support the complex strategies required to find an edge in the equities market.

Trade Corporate Events

Deploy event-driven algorithms to capitalize on the volatility surrounding earnings reports, M&A announcements, and product launches. Our low-latency infrastructure ensures your strategy can react to news faster than the market.

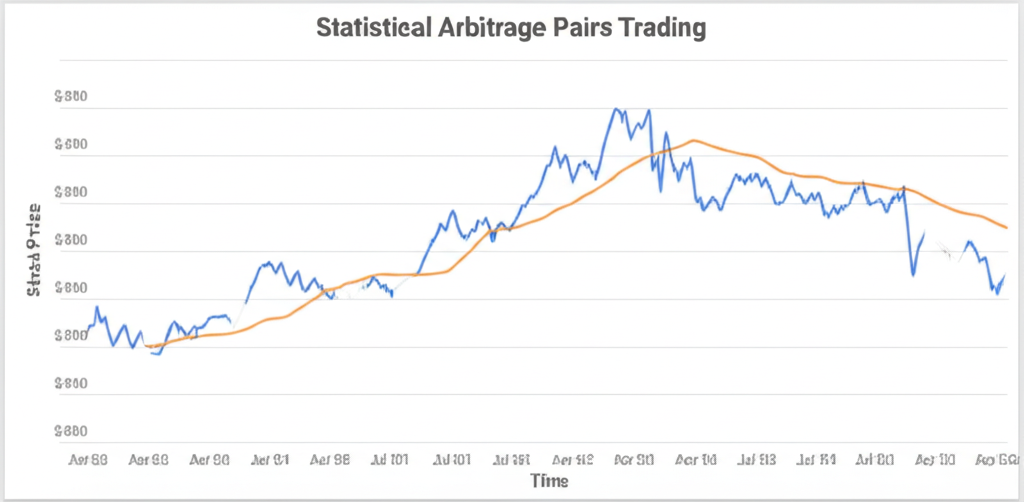

Execute Pairs Trading

Build sophisticated statistical arbitrage models. Program your system to trade the relative value between two correlated stocks (e.g., NVDA vs. AMD), profiting as their price ratio reverts to its historical mean, regardless of market direction.

Build Long/Short Strategies

Create market-neutral portfolios by simultaneously going long on undervalued stocks and shorting overvalued ones within the same sector. This allows your algorithm to isolate alpha and reduce systemic market risk.

Popular Stocks on NYSE & NASDAQ

Access deep liquidity on the world's most traded companies.

AAPL

Apple Inc.

MSFT

Microsoft Corp.

NVDA

NVIDIA Corp.

TSLA

Tesla, Inc.

AMZN

Amazon.com, Inc.

GOOGL

Alphabet Inc.

JPM

JPMorgan Chase & Co.

V

Visa Inc.

| Symbol | Commission (per share) | Max Leverage | Dividend Adjustment |

|---|---|---|---|

| AAPL | $0.02 per share | 1:20 | Paid on Longs, Debited on Shorts |

| TSLA | $0.02 per share | 1:20 | Paid on Longs, Debited on Shorts |

| NVDA | $0.02 per share | 1:20 | Paid on Longs, Debited on Shorts |

| AMZN | $0.02 per share | 1:20 | Paid on Longs, Debited on Shorts |

The Drovix Advantage for Stock Traders

Access Over 2100 Global Stocks

Trade CFDs on the world's biggest companies from the NYSE, NASDAQ, and more.

No Short-Selling Restrictions

Develop algorithms that profit from both rising and falling markets without the typical constraints.

Capture Total Return

Your long positions receive dividend adjustments, allowing your algorithms to capture full value.

Direct Market Access (DMA) Pricing

Trade on real-time exchange prices with transparent, low commissions for true market depth.

FIX API Connectivity

For the ultimate in performance, connect your institutional-grade trading systems directly to our servers.

Leverage up to 1:20

Amplify your strategic positions and increase your capital efficiency on single stock trades.